How Ordinals-inspired inscriptions caused outages and gas fee spikes across top chainsShare this article …

Long Reads

Long Reads

Expert Opinions

Expert Opinions

Latest Podcasts

Latest Podcasts

Latest Videos

Latest Videos

The Reporter Newsletter

Stay Connected

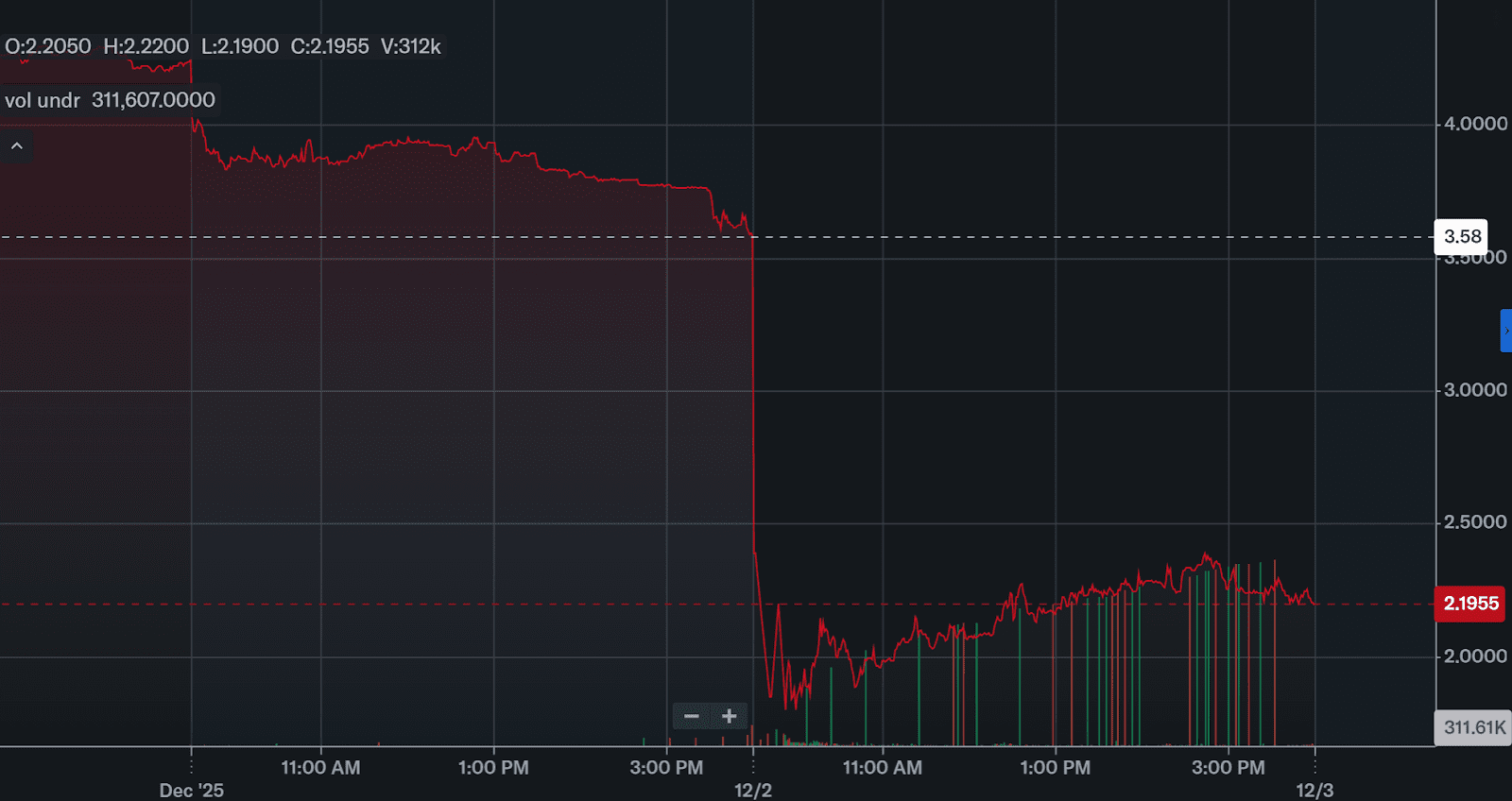

TLDR Bitcoin surged more than 10% against gold as the precious metal saw a significant drop. Anthony Scaramucci expects Bitcoin to hit $150,000 despite market shifts. Gold faced a major crash, while silver saw its largest drop ever, losing over 30%. Cathie Wood predicts the end of gold’s rally, signaling potential changes in market trends. 💥 Find the Next KnockoutStock! Get live prices, charts, and KO Scores from KnockoutStocks.com, the data-driven platform ranking every stock by quality and breakout potential. In the world of cryptocurrencies, major events often spark strong reactions. Recently, Bitcoin (BTC) surged more than 10% against gold, catching the attention of investors and financial analysts alike. Anthony Scaramucci, the founder of SkyBridge Capital, has warned Bitcoin holders to “get ready” as the leading cryptocurrency strengthens. Silver and Gold down. Bitcoin firming. Get ready. — Anthony Scaramucci (@Scaramucci) January 30, 2026 This shift comes as gold, a traditional safe-haven asset, is experiencing a notable decline. Scaramucci’s comments highlight growing concerns about the future of precious metals and the rising potential of Bitcoin. Bitcoin’s Rise and Gold’s Decline Bitcoin’s recent performance has drawn considerable attention. As the cryptocurrency market continues to evolve, Bitcoin has managed to outperform gold, which is traditionally seen as a secure investment. Earlier today, Bitcoin gained more than 10% against gold, a remarkable rise given the volatility of the digital currency market. This surge in Bitcoin’s value comes at a time when gold has faced a sharp downturn. Gold dropped to an intraday low of …

Watch Now

Tony Kim Feb 01, 2026 16:35 EXCERPT : CRV price prediction shows potential recovery from oversold …

Recommended Videos

Recap

Australia’s proposed crypto law, which adds “digital asset platform” and “tokenised custody platform” under the Corporations Act, has broad industry support. Industry feedback focuses on three issues: defining the scope and discretion of regulators, clarifying how local platforms can legally source offshore liquidity, and providing key mechanics currently deferred to future ASIC guidance. Though welcomed, …

Aerodrome Finance suffered a DNS hijack, redirecting users to phishing sites, though smart contracts and funds remain secure. Users are advised to use ENS mirrors (aero.drome.eth.limo) and revoke recent token approvals; the team is investigating with My.box. The attack follows past front-end exploits and the merger with Velodrome, highlighting persistent security risks in DeFi. Aerodrome …

Bitcoin briefly dipped below US$84k early Tuesday morning Australian time before recovering above US$86,547, while Ethereum fell below US$3k. QCP Capital attributed the downturn to weak weekly and monthly closes, post-Thanksgiving US trader selling pressure, and Asia-driven headwinds including Japan’s potential rate hike. BRN’s Timothy Misir characterised the sell-off as a liquidity and positioning shakeout …

Bitcoin saw a 6% uptick, climbing back above $92K. This sparked a broad market rebound after a sharp selloff wiped out nearly $1 billion in leveraged positions. While traders welcomed supportive industry headlines, overall sentiment remains fragile amid ongoing market stress. Despite the price rise, negative funding rates indicate traders remain bearish, suggesting the recovery …

Promote Your Brand with Us

Reach an engaged audience with high-visibility ad placements.

Starting from just $50/day.